What is Discounted Cash Flow or DCF?ĭiscounted cash flow (DCF) is a valuation method that uses predicted future cash flows to determine the value of an investment. The DCF-method is especially useful in this case because it considers future performance rather than the current state of your startup. It is not rare for startups to earn no revenue at all during the (pre-)seed stage, while negotiations about equity transfers, ownership percentages, and value begin. It’s ideal for a company that hasn’t yet achieved any historical performance. The DCF approach rates a company based on its future performance. Discounted Cash Flow Model for Startup Valuation The results of the valuation calculator do not serve as an independent qualified appraisal or valuation opinion. Eqvista has no obligation to defend or represent any part of the assumptions or calculations used or results from the business valuation calculator, and should be taken “as is” without warranty of any kind. assumes no responsibility nor liabilities for any consequences from the calculated results and provides no assurances of the applicability or accuracy of the valuation results for your company.

#DCF CALCULATOR FULL#

Use of this calculator is at the own risk of the Preparer, and they take full responsibility for the provided inputs, assumptions, and calculations of the report. Getting a proper valuation done is still the best way to find the value of your company.ĭisclaimer: This DCF calculator is for information purposes only. It’s important to remember that the value you get in this calculator is only for your reference. The calculator will then produce the total value of your company. To use the DCF calculator, simply enter your industry, years in business, total revenue, total profit, and future growth rate. Calculator section & Instructions/Disclaimer This calculator is perfect for startups who want to get a rough idea of their company’s value, especially when most startups have yet to generate revenue. This calculator helps to share your calculations by URL.Eqvista has created a DCF calculator to help you find your company’s value based on your company’s predicted future cash flows.And also can see the intrinsic value in words. Users can see the accurate value of the intrinsic value, growth value and terminal value.It helps to calculate the actual value of the asset or company and helps to project your future profit earnings.What can you do with Discounted Cash Flow Calculator? Yt is a number of years in terminal growth rate.

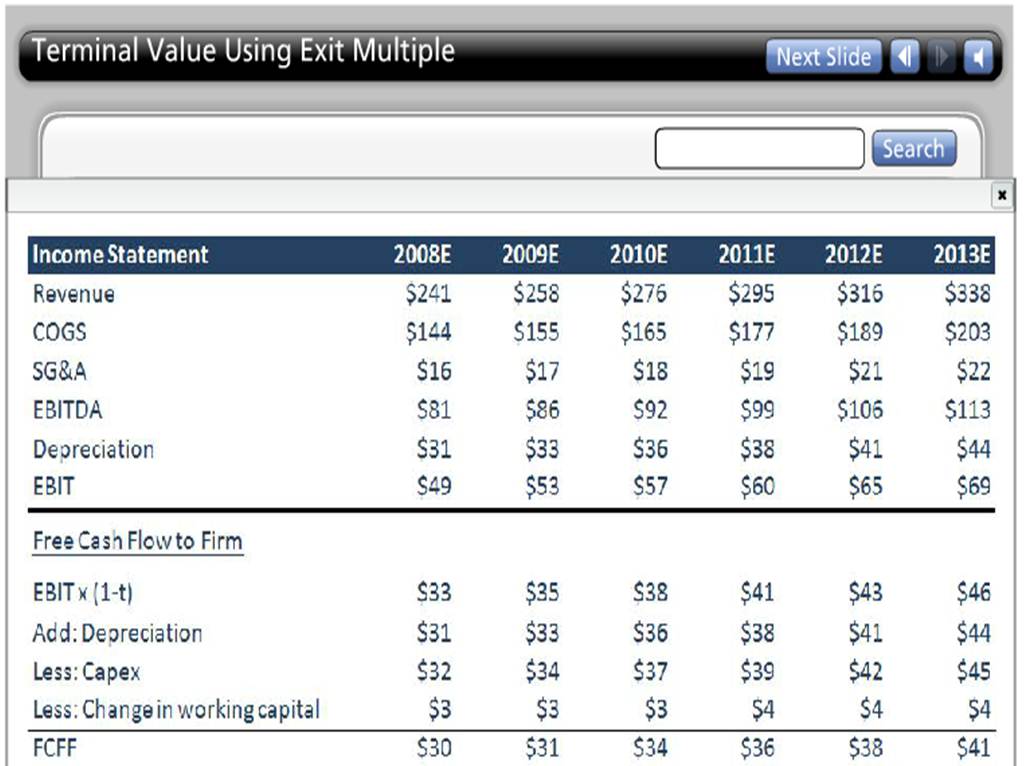

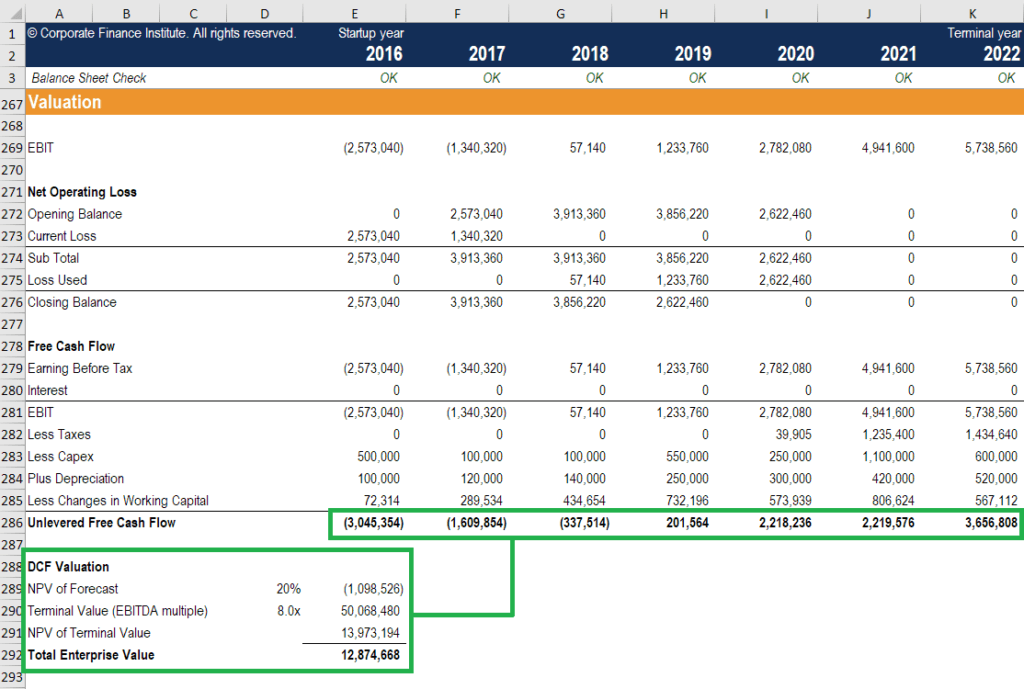

Yg is a number of years when your buisness is growing at the grow rate.Now, intrinsic value = growth value + terminal value The discounted cash flow formula to calculate growth value, terminal value, and Intrinsic value is as follows:įirst part is, growth value = EPS * A * (1 - A Yg ) / (1 - A)Īnd second part is, terminal value = EPS * A Yg * B * (1 - B Yt ) / (1 - B) It was widely used in the finance industry in the 1700s or 1800s, widely discussed in financial economics in the 1960s, and started widely used in U.S.

It is mostly used by investors to check whether their investment will make a valuable profit or not. Discounted Cash Flow analysis is widely used in finance Investment, real estate, and corporate finance management. A discounted cash flow analysis is a method of asset or company valuation.

0 kommentar(er)

0 kommentar(er)